Hamilton | Hardee | Hendry | Hernando | Highlands | Hillsborough | Holmes Alachua | Baker | Bay | Bradford | Brevard | BrowardĬalhoun | Charlotte | Citrus | Clay | Collier | ColumbiaĭeSoto | Dixie | Duval | Escambia | Flagler | Franklin Please note that within many counties, there may not be designated evacuation zones.ĭURING AN EMERGENCY, YOUR LOCAL EMERGENCY MANAGEMENT PROGRAM SHOULD ALWAYS BE CONSULTED REGARDING EVACUATION ORDERS. These county-wide evacuation route and zone maps are based upon the most up-to-date regional evacuation studies and are intended for general reference. Interior counties do not have designated evacuation zones.Įvacuation Zones - enter an address or use your device location to Know Your Zone and view designated evacuation zones.Įvacuation Routes - enter an address or use your device location to Know Your Zone and view nearby designated evacuation routes. For most coastal Florida counties, evacuation zones have been designated.

#Suwannee county fema flood zone map registration

Importance of Registration with Your Local EOC.Nuclear Power Plants Emergency Classification Levels.Fire Management Assistance Grant Program.Comprehensive Emergency Management Plan.Building Resilient Infrastructure and Communities (BRIC) Grant Program.Work Opportunities at the Division of Emergency Management.

#Suwannee county fema flood zone map free

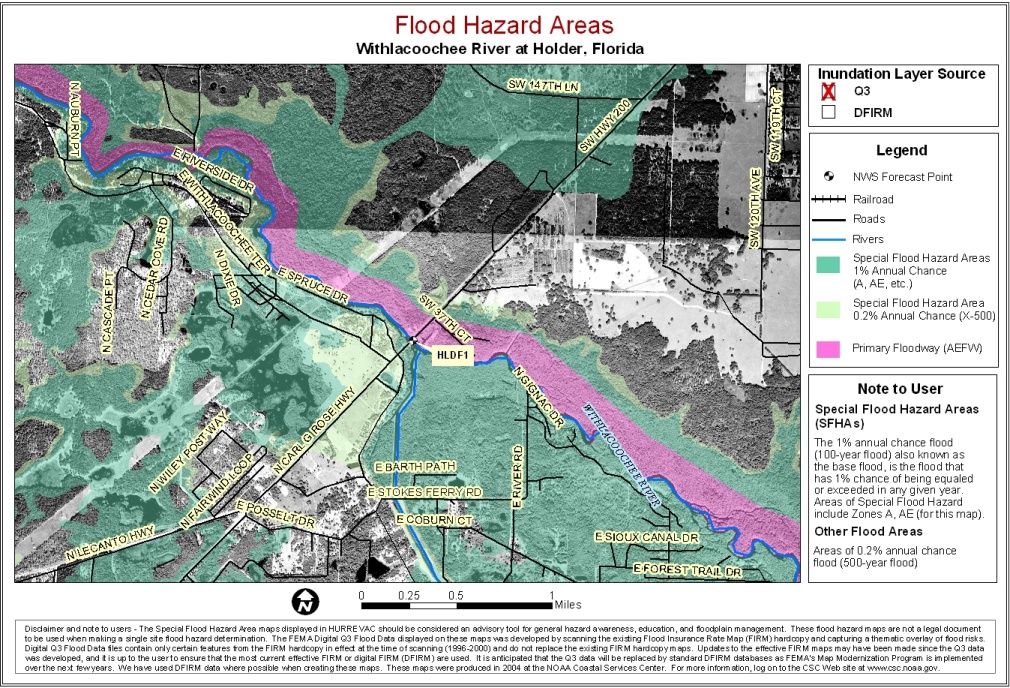

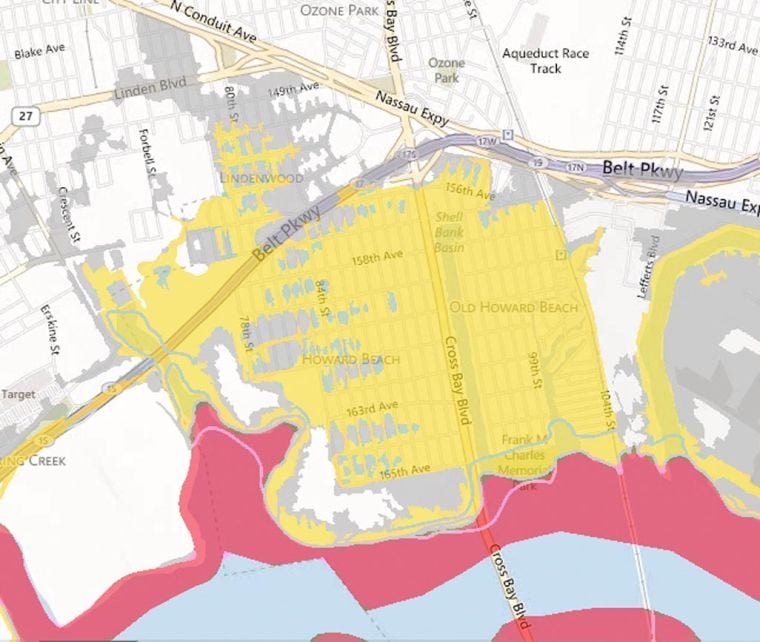

If you have any questions or concerns, please feel free contact any member of Henderson Franklin’s Real Estate attorneys at 23. Property owners would be wise to consider hiring an attorney to protect their interests before signing on the dotted line. On the other hand, if your building elevation is below the recommended level, it’s a risk aversion question for you: Do you think the risk of flooding and the damage associated with that flooding is worth the insurance premium? If you had a lender, you would have known you were in a flood zone, and the lender would have required you to obtain insurance to protect their collateral. If your elevation is high enough, FEMA might not recommend flood insurance, but it still may be a good idea to purchase it. More specifically, I’d suggest getting an elevation certificate to see if your building elevation puts you at risk of flooding based on FEMA’s Flood Insurance Rate Maps. What should you do if you bought home in a flood zone but didn’t know it at the time of purchase? You should look into whether you think you need flood insurance.How does a being in a flood zone affect price? If you’re in a high risk flood zone, the buyer is likely to consider the higher flood insurance cost when proposing a purchase price.If you obtain financing, your lender is going to require you to know your flood zone. Some sellers and their agents are aware of their property’s flood zone status, while others aren’t. Is this information usually disclosed to home shoppers or do you need to inquire? It depends.Your local Property Appraiser’s GIS system often has flood zone overlays, as well. Where can you look to find out if your property is in a flood zone? The FEMA Map Service Center is a good resource, visit.Below are some resources and answers to frequently asked questions on flood zones: As we approach the height of hurricane season, it’s a good time for property owners to brush up on their understanding of flood zones and how they impact flood insurance.

0 kommentar(er)

0 kommentar(er)